How Many Times Can You Trade Forex in a Day?

A very common question among forex traders is, “How many times can you trade forex in a day?” The forex market is open 24 hours a day during weekdays, which makes it very flexible compared to other financial markets. This flexibility often leads traders to believe they should trade constantly, but that assumption can be risky. The reality is simple: there is no fixed limit on how many times you can trade forex in one day. You can place one trade or dozens. However, successful trading is not about how often you trade; it’s about how well you trade. Understanding this difference is what separates consistent traders from those who struggle.

A very common question among forex traders is, “How many times can you trade forex in a day?” The forex market is open 24 hours a day during weekdays, which makes it very flexible compared to other financial markets. This flexibility often leads traders to believe they should trade constantly, but that assumption can be risky. The reality is simple: there is no fixed limit on how many times you can trade forex in one day. You can place one trade or dozens. However, successful trading is not about how often you trade; it’s about how well you trade. Understanding this difference is what separates consistent traders from those who struggle.

Is There a Maximum Limit on Daily Forex Trades?

Unlike stock trading, forex does not have a rule that limits the number of trades you can make per day. As long as the market is open and you have enough margin, you are free to enter and exit trades.

That said, your broker may apply certain conditions depending on your account type, such as restrictions on scalping or extremely fast trades. Even when there are no broker restrictions, your own capital, discipline, and emotional control naturally limit how often you should do currency trading. Trading frequently without a clear reason often leads to unnecessary losses.

How Trading Style Determines Trade Frequency

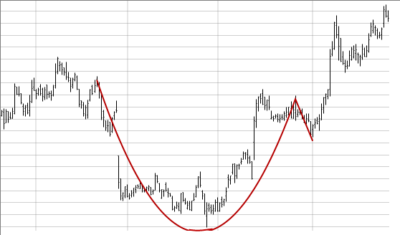

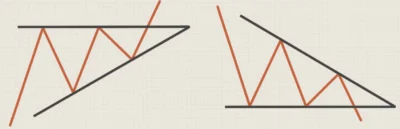

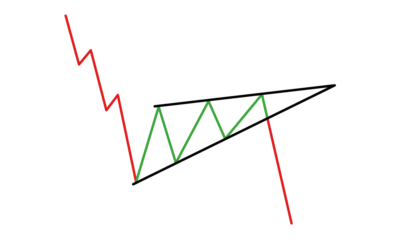

The number of forex trades you make in a day largely depends on your trading style. Scalpers may trade many times a day because they focus on very small price movements. Day traders usually take a few trades during active sessions and close positions before the day ends. Swing traders and position traders trade far less frequently, sometimes holding positions for days or even weeks.

There is no “best” trading style. The best approach is the one that matches your personality, time availability, and risk tolerance.

Why More Trades Do Not Mean More Profit

Many traders fall into the trap of thinking that more trades will automatically increase profits. In reality, trading too often usually leads to poor decisions, emotional stress, and higher trading costs.

Many traders fall into the trap of thinking that more trades will automatically increase profits. In reality, trading too often usually leads to poor decisions, emotional stress, and higher trading costs.

Overtrading often happens when traders feel bored, try to recover losses quickly, or trade without waiting for proper setups. Professional traders understand that patience is part of the strategy, and sometimes staying out of the market is the smartest decision.

How Many Trades Per Day Are Reasonable?

There is no perfect number, but most successful traders keep their daily trades within a manageable range. Beginners often perform better when they focus on one or two high-quality trades instead of trying to trade every market move.

As experience grows, traders may increase frequency, but only when they can maintain discipline and consistency. What matters most is that every trade has a clear reason behind it.

Key Factors That Should Control Your Daily Trade Count

Before deciding how often to trade forex in a day, you should always consider the following points:

- Market volatility and available trading opportunities

- Your risk management rules and stop-loss discipline

- Account size and margin availability

- Mental focus and emotional stability

Strategy Matters More Than Trade Count

Instead of focusing on how many times you can trade forex in a day, it’s far more important to focus on the quality of your strategy. A strong strategy naturally limits unnecessary trades and keeps you aligned with high-probability setups.

If you are still building your foundation, linking this topic with a pillar guide such as What Is Forex Trading and How It Works can help strengthen your overall understanding and decision-making.

(FAQs)?

1. Can I trade forex unlimited times in a day?

Yes, technically you can trade as many times as you want, but trading too frequently without a strategy increases the risk of losses.

2. Is trading forex many times a day risky?

It can be risky if done without discipline. High trade frequency increases emotional pressure and trading costs.

3. How many forex trades should a beginner take daily?

Most beginners should limit themselves to one or two well-planned trades per day.

4. Does trade frequency affect profitability?

Yes, overtrading often reduces profitability due to poor entries, stress, and higher transaction costs.

5. Is it better to trade forex daily or less often?

This depends on your trading style. Some traders prefer daily trades, while others perform better with fewer, longer-term trades.

Final Thoughts

So, how many times can you trade forex in a day? The honest answer is that there is no limit, but there is a smart approach. Profitable trading is not about constant action; it’s about patience, discipline, and choosing the right moments to trade. Focus on quality over quantity, protect your capital, and let your strategy, not emotions, decide how often you trade.